Table of Contents

What Is Perfect Competition?

The concept of perfect competition describes a theoretical market structure. In a model of perfect competition, there are no monopolies1. This type of structure has several key characteristics, including:

- All firms sell an identical product (a commodity or homogeneous).

- All firms are price takers (they cannot influence the market price of their products).

- Market shares do not affect prices.

- Buyers have complete or perfect information (past, present, and future) about the product sold and the prices charged by each company.

- Capital resources and labor are fully mobile.

- Businesses can enter and exit the market for free.

It Can be contrasted with the more realistic imperfect competition that exists whenever a hypothetical or actual market violates the abstract principles of neoclassical pure or perfect match.

Principle Results

- Perfect competition is an ideal market structure where all producers and consumers have complete and symmetric information and no transaction costs.

- In such an environment, many producers and consumers compete.

- Perfect competition is theoretically the opposite of a monopolistic market.

- Because all fundamental markets exist outside the plane of the perfectly competitive model, each can be classified as imperfect.

The opposite of perfect competition is when a market violates the abstract principles of neoclassical pure or ideal match.

How Perfect Competition Works

Perfect competition is a benchmark or ideal type against which actual market structures can be compared. In theory, perfect competition is the opposite of a monopoly, where only one firm offers a good or service. That firm can charge any price because consumers have no alternative, and it is difficult for potential competitors to enter the bazaar.

Several buyers and sellers in perfect competition, and prices reflect supply and demand. Companies make enough profit to stay in business and nothing more. If they made excessive profits, other companies would enter the market and drive down profits.

A Vast And Homogeneous Market

In a highly competitive market, there are many buyers and sellers. Sellers tend to be small businesses rather than large companies able to control prices through bid adjustments. As a result, they sell products with minimal differences in capabilities, features, and price. In addition, it ensures that buyers cannot differentiate products based on physical characteristics such as size or color or intangible values such as brand names.

Full Availability Of Information

Full Availability Of Information

Information about an industry’s ecosystem and competition is a crucial asset. For example, knowing how to find components and pricing from suppliers can make or break the market for some companies. In addition, in certain knowledge-intensive and research-intensive industries, such as pharmaceuticals and technology, competitor patent information and research initiatives can help companies develop competitive strategies and create a competitive advantage around their products. Products.

Lack Of Control

Governments play a crucial role in shaping product markets by imposing regulations and price controls. In addition, they can control the entry and exit of businesses in a market by establishing rules for operating in the market. For example, the pharmaceutical industry has to deal with several regulations related to drug development, manufacture, and sale.

Special Considerations

Actual competition deviates from this ideal mainly through production, marketing, and sales differentiation. For example, a small health food store owner may talk at length about the grain that feeds the cows that produce the manure used to fertilize non-GMO soybeans. It is called differentiation.

The first two criteria (homogeneous products and price takers) are anything but realistic. For the second two criteria (information and mobility), however, the global evolution of technology and commerce improves the flexibility of information and resources.

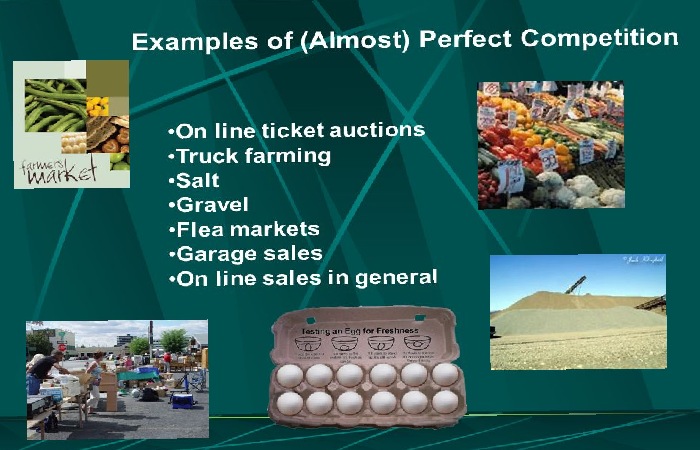

Examples of Perfect Competition

As stated above, the idea of perfect competition is far from reality. Though it can be challenging to number out practical examples of ideal competition, several variants are available daily. Let’s take an example of a farmer’s market with many sellers and buyers selling and buying goods. Here, you will see significantly less difference in the goods and the taxes at which they are made available to consumers. Because of the resemblance in nature of the harvests, the primary source of produce won’t be significant, and there will be a slight difference in their packaging or branding approach. Hence, the exit or closure of one farming firm won’t impact the entire market. Also, the average prices won’t fluctuate due to such doors. An additional example could be 2 supermarket supplies where similar products from similar firms are stocked in aisles.

These products would seem similar in appearance and prices and will offer the same features too. Also, crops that are not proprietary fall under perfect competition. They are again identical and are available at cheaper rates. Furthermore, the pricing plan for product knockoffs is the same, and they are hard to be differentiated easily. If a society producing such product becomes non-operative, it gets substituted by another firm.

As new firms are mounting and entering the tech business, we can relate it to perfect competition. For instance, many sites, such as Sixdegrees.com, Asianave.com, Blackplanet.com, etc., rummage-sale to offer the same services when social media networking was utterly new. There were no costs related to these sites, and they didn’t have any considerable market part. The users of these sites were usually school and college-going students. As these organizations had minimal start-up costs, it was easier for them to arrive and exit the marketplace. Skills like Java were made available for public use. Also, there remained no capital expenditures involved.

What are the drawbacks of Perfect competition models?

Perfect competition creates a specific model for the start of a market. However, the such market suffers from a few drawbacks. As firms produce similar products, the sense of invention and creativity somehow becomes destroyed in this process. The firms can be ground-breaking to get a more significant market share and be more competitive than other companies by donating premium quality products. However, no organization well-known in perfect competition has a substantial market share. The demand and source of products ascertain the success of a firm. So, it is difficult for corporations to be exclusive and offer customers products and services at a higher price.

For instance, companies like Apple won’t find operating in a perfectly competitive market feasible. It is so since its iPhones are unique and thoughtfully priced compared to its competitors. The second drawback that flawless competition faces is the lack of economies of scale. If the companies aim to receive enough profit margins to stay in the market, they won’t have adequate funds to invest in further expansion and growth. If the firm increases its production volume, it will lead to a reduction in costs and an increase in income limits. However, due to the enormous size of companies in this market, achieving the overhead objectives of cost minimization and profit maximization is difficult. Also, it ensures that the regular size of the company operating in a competitive market tends to be less.

Do firms make profits in a perfectly competitive market?

Firms operating in a perfectly competitive market don’t make any profits. There can be some stages when companies make some income. But the marketplace situations tend to nullify the effects of positive or negative gains and set them in an equilibrium position. Because of free information, other officialdoms will make differences in their production activities to arrive at uniformity with the organization with a profit margin. In perfect competition, companies’ average revenue and marginal revenue are equivalent to the product’s price. This creates a situation of market evenness that was not present before. With the change of call and supply, the incomes and wounded of firms turn out to be nothing in the extensive run.

Does perfect competition be in the actual creation?

The competition usual in the world doesn’t fit in the perfect race model because of disparity in business, marketing, and selling approaches. For instance, the owner who sells biological farm harvests can provide essential facts about the type of food fed to cattle whose dung was used to harvest non-GMO soybeans. This is a part of the variation. With the help of different marketing strategies, companies tend to have higher valuing power and more market share. Their objective is to create brand individuality in the market. Hence, the primary workings, including like products and price takers, seem vague. The next couple of features, including accessible information and mobility, are still being operated upon by the tech and trade industries to improve knowledge and instill more flexibility in resources. Even though the perfect competition is far after the truth, it helps explain many reality-based scenarios.

Barriers to Entry Prohibit Perfect Competition

Several barriers to entry can discourage a new firm from entering a perfectly competitive market. Some include more start-up costs, stringent government rules, and policies, and much more. The customer has become smarter with the progress of technology. There are a few areas where the client has information about all products and their values. Many barriers don’t allow perfect competition to occur in today’s world. For instance, many small manufacturers have no information or influence over the product’s prices in the agricultural sector. Aware of the market prices, commercial buyers take advantage of this condition. Though there can be some walls to entry into the farming industry,

Features of Perfect Competition

The main structures of perfect competition are as follows:

Many Purchasers and Sellers – There will continuously be many buyers and sellers in this marketplace. The benefit of having a large amount of small-sized creators is that they cannot trust to influence the market price. If the quantity presented by an individual seller is minimal compared to the total market produce, they cannot control the market price self-sufficiently.

Similarly, if there are many buyers, then a separate will not have the power to dictate situations to the market or affect the value by changing demand for a product. The individual request will not be large enough to vary the price.

Homogeneity – The product or facility shaped by the buyers in a perfectly competitive market should be homogenous in all respects. There should be no differentiation between them in terms of quantity, size, taste, etc., so the products are perfect alternatives for apiece other. If a seller tries to charge an advanced price for crops that are so similar, they will lose their clientele directly.

Free Entry and Exit – Another illness of a perfectly competitive market is that no fake limits prevent a firm’s entry or compel a current firm to stay put when they want to leave. Their decision to enter, remain, or permission the market is contingent purely on financial issues.

Perfect Knowledge – The buyers and sellers have excellent knowledge about market situations. The buyers are alert to the details of the creation sold as well as its price. At the same time, the sellers know about the possible sales of their products at different price points. Since the buyers are already well-versed in the development, there is no need for publicity or sales elevation. So companies don’t have to invest a single currency in these doings. It also helps sellers save on publicity or other marketing doings, which keeps the price of their harvests low.

Mobility of Factors of Making – The factors of production like labor, raw resources, and capital should have total mobility under perfect competition. The workers should be free to move from one home to another depending on their payment. Even the raw resources and capital should not have any restrictions on movement.

Transport Cost – In a perfectly competitive market, the costs for bringing goods, services or factors of making from one place to another are either zero or endless for all sellers. The assumption is that all sellers are similarly near or beyond away from the market. Thus, the transport cost is unchanging for all of them. The effect is that the overall costs for making and the marketing price are the same across the board.

Absence of Artificial Limits – There is no interference from the government or any other regulatory body to delay the smooth effect of a perfect race. There are no controls or limits over the supply or value, and the price can alteration exclusively founded on the request and supply conditions.

Uniform Price – There is a single uniform value for all harvests and services in a perfectly competitive market. The forces of demand and supply regulate it.

Frequently Asked Inquiries on Perfect Competition

Why is a firm known as a price taker in a competitive market?

A firm is a price taker in an effortlessly competitive market because it is under compression from rival firms to take the symmetry price prevailing. If the firm advances the price of its harvests even by a small margin, it will misplace all its sales to participants.

What is the main difference between perfect race and monopoly?

The main difference between perfect competition and monopoly is that ideal competition involves many buyers and sellers, but control has a single vendor and many buyers.

Give an example of a difference between perfect and monopolistic competition.

There are several differences between perfect and controlling struggle. One of them is that the firms under faultless match are price-takers, and those under monopolistic competition are price-makers.

Give a sample of the difference between perfect struggle and oligopoly.

There are several differences between perfect and oligopoly. One of them is that in perfect competition, the firms earn zero profit in the long run, but in an oligopoly, the firms earn an economic profit in the long run.

Why do firms have zero profit in the long run under perfect competition?

Many firms produce high quantities of homogenous products in a perfectly competitive market. Firms can enter the market without restrictions, and all consumers have complete information about the product. So, if a firm raises the price of its development, the consumers will stop buying from them and switch to another seller. Thus, they have zero opportunity to make a profit in this market.

Conclusion

Perfect competition is one of the most smoothly functioning markets, with many buyers and sellers working together in total harmony. Unfortunately, it is a hypothetical situation that does not exist in reality. But markets should aim to be as close as possible to this call to ensure a fair price for all goods and services.